Time Series Analytics: Bitcoin Algorithmic Trading

IDSS PI: Devavrat Shah

Collaborators: Muhammad Jehangir Amjad (MIT), Usman Ayyaz (MIT), George Chen (MIT), Andrei Ivanov (MIT), Sanjeev Mohindra (MIT), Nils Molina (MIT), Stanislav Nikolov (MIT), Kang Zhang (MIT), MIT Lincoln Laboratory Beaver Works Center

With the ubiquity of time series data available today, there has been significantly increased interest in our ability to understand the structure in these data sets so as to make predictive decisions based on it. Examples include anomaly detection in real-time services, fraud alerts, predicting election outcomes, and algorithmic financial trading. Such data sets are invariably very high volume and usually require real-time analysis for prediction and decision making.

The primary purpose of the Bitcoin algorithmic trading project, conducted by Prof. Devavrat Shah and his research group, is to take on this challenge of effectively using time series data. To that end, his team has developed a large scale statistical and machine learning platform for storing, processing, and predicting using time series data. Concretely, the platform allows for

-storing and processing time series data of massive size,

-helping understand the structure of the data,

-making real-time high fidelity predictions, and

-aiding decision making using such data

Their statistical / machine learning / computation system incorporates the time series prediction methods developed by Prof. Shah’s group. It should be noted that there is a large body of literature on statistical modeling of time series data. The platform, in addition to the methods developed by Prof. Shah, includes traditional approaches.

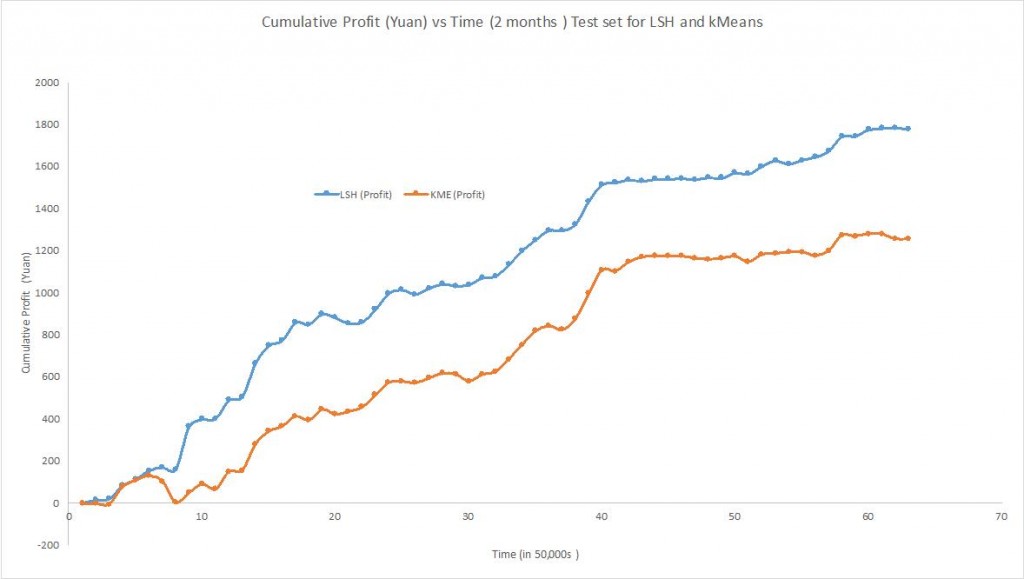

To demonstrate the efficacy of their method, the group developed a simple algorithmic trading scheme based on Bitcoin trading data, which is available in real-time from exchanges like Okcoin.com. First, the group was able to predict the price of Bitcoin in real-time. Then, based on these predictions, they used a very simple algorithmic trading scheme to decide whether to buy or sell a Bitcoin while maintaining the position of +1 / 0 / -1 Bitcoin each time.

This simple trading algorithm highlights the efficacy of predictions over a potentially complex trading algorithm. The group used their method over different time periods to show that significant profit can be made in reasonably short duration. Specifically, the overall profit of 1842 Yuan can be earned in 35 days using their method, as shown in the figure below. The average price of Bitcoin during this time was 3284 Yuan. That is, the group effectively obtained 57 % return on investment over the period of 35 days.

Prof. Shah’s group has used this method previously for trend prediction using Twitter data. This method managed to predict the trends accurately with 95% accuracy and 4% false positive rate. The predictions were made, on average, more than 1 hour in advance.

References and Related Content:

“Bayesian regression and Bitcoin” – Proceeding of the Allerton Conference on Communication, Computation and Control, October 2014.

“MIT computer scientists can predict the price of Bitcoin” – MIT News, October 2014.