Finance

As financial markets have undergone rapid transformations in the past two decades due to technological advances, organizations, including banks, asset management firms, telecom and IT firms, and government regulatory agencies, are all: 1) far more interconnected; 2) managing transactions at sub-millisecond time scales; and 3) generating, storing, and managing masses of data from these transactions. IDSS research aims to address problems caused by the confluence of these issues. For example, understanding and managing systemic risk across financial systems requires a more complete understanding of how shocks and disruptions can propagate through the system and how the structure and nature of the interconnections can make such systems susceptible to cascading failures. Research at IDSS aims to establish and build trust in financial systems, creating better, more stable, and productive financial systems around the globe.

Read more about IDSS research in finance in this article: “Using new models and big data to better understand financial risk” (IDSS/MIT News).

Also, IDSS hosted a workshop on “Data, Analytics, and Risk in Finance” in April 2016. View videos and a summary report of the workshop on the event website.

Examples of topics in this domain include:

- How do we map and develop robust models and metrics of systemic risk across multiple financial systems? How can we use these models to better manage uncertainty and predict failures in the finance sector?

- How can big data help us map the financial industry so we can better understand patterns and interdependencies and forecast changing dynamics?

- Can we develop new financial forecasting tools that help mitigate financial vulnerabilities and crises?

- What is the impact of financial interconnectedness on the U.S. economy; and can we model and control certain configurations of this network?

- How can we better leverage behavioral science and decision-making to better understand consumer and investor behavior?

- How can we promote new ways of managing and sharing financial data across communities? How can we improve access to data for research?

Daron Acemoglu, Asuman Ozdaglar

Recent research by IDSS faculty Daron Acemoglu, Asuman Ozdaglar, and their collaborator Alireza Tahbaz-Salehi (Columbia University) develops a unified framework for the study of how network interactions can function as a mechanism for propagation and amplification of microeconomic shocks. Examining these relationships provides important information about the role of underlying network architecture in fostering systemic risk. Their research shows that financial contagion has a “robust-yet-fragile” characteristic: the financial interconnections in a dense network create stability in response to small shocks but become powerful dominoes when shocks are large.

Devavrat Shah

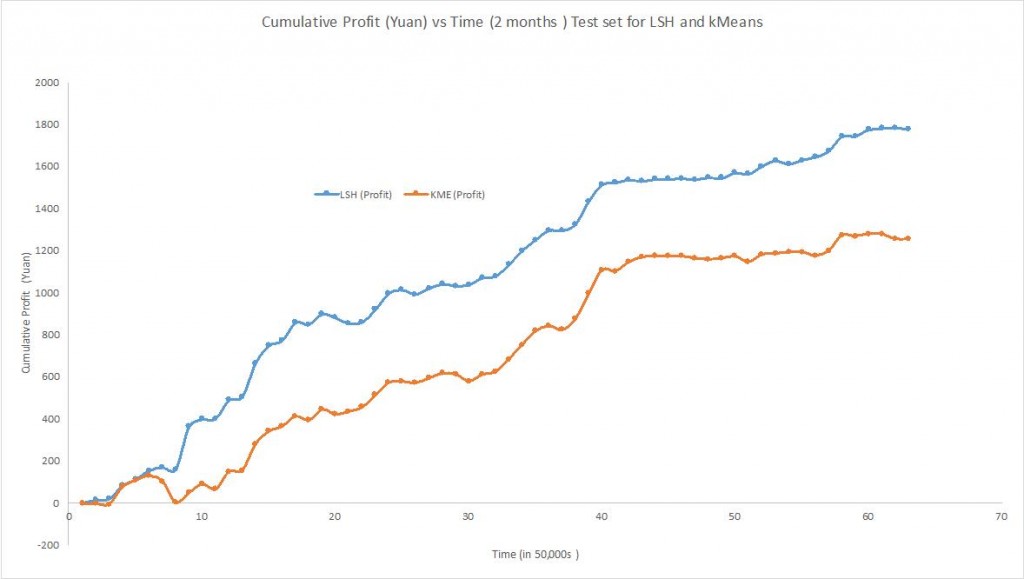

With the ubiquity of time series data, there is significant research interest in the application of machine learning methodologies to such datasets. Pattern-matching, for instance, is a problem of great interest in the world of time series datasets. From anomaly detection in real-time services to predictions about the movement of financial indicators, time series pattern-matching problems invariably involve high-volume and rapidly growing datasets. Therefore, in addition to the statistical validity, the scale of the datasets creates a significant engineering hurdle in the quest to match patterns and predict outcomes in real-time. The goal of this research was to develop a simple but successful Bitcoin algorithmic trading strategy relying on low-latency approximate-algorithms for time series pattern-matching to predict future movements in the price of Bitcoin.

Andrew Lo

Unlike other industries in which intellectual property is patentable, the financial industry relies on trade secrecy to protect its business processes and methods, which can obscure critical financial risk exposures from regulators and the public. This research develops methods for sharing and aggregating such risk exposures that protect the privacy of all parties involved and without the need for a trusted third party. This approach employs secure multi-party computation techniques from cryptography in which multiple parties are able to compute joint functions without revealing their individual inputs. In this framework, individual financial institutions evaluate a protocol on their proprietary data which cannot be inverted, leading to secure computations of real-valued statistics such as concentration indexes, pairwise correlations, and other single- and multi-point statistics. Potential financial applications include: the construction of privacy-preserving real-time indexes of bank capital and leverage ratios; the monitoring of delegated portfolio investments; financial audits, and the publication of new indexes of proprietary trading strategies.

Sandy Pentland

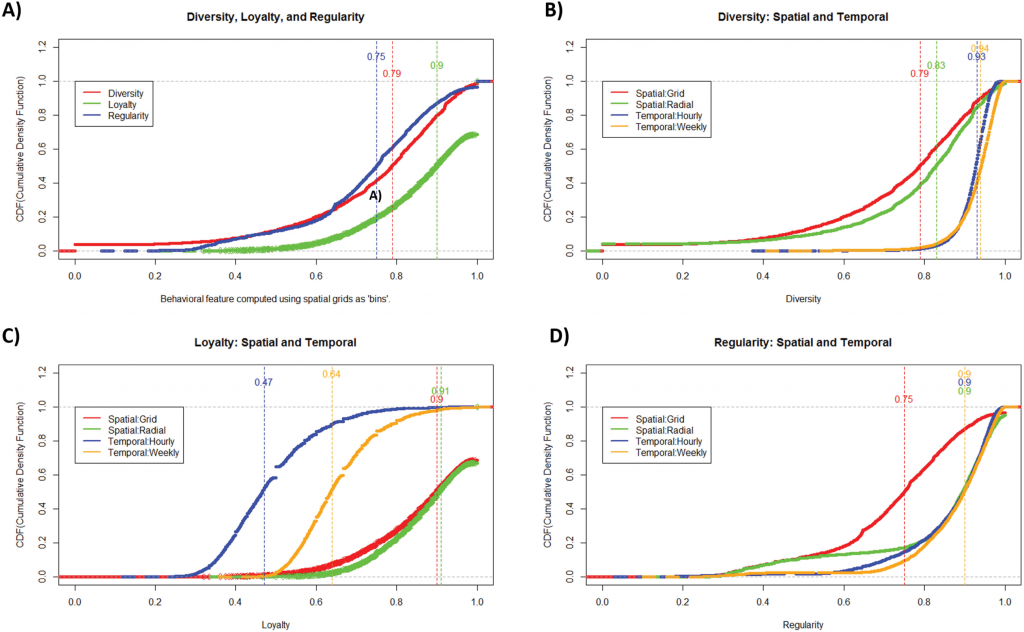

Traditional financial decision systems (e.g. credit) have had to rely on explicit individual traits like age, gender, job type, and marital status, while being unable to account for spatio-temporal mobility or the habits of the individual involved. Emerging trends in geo-aware and mobile payment systems, and the resulting “big data,” present an opportunity to study human consumption patterns across space and time. Taking inspiration from animal behavior studies that have reported significant interconnections between animal spatio-temporal “foraging” behavior and their life outcomes, researchers analyzed a corpus of hundreds of thousands of human economic transactions and found that financial outcomes for individuals are intricately linked with their spatio-temporal traits like exploration, engagement, and elasticity. Such features yield models that are 30% to 49% better at predicting future financial difficulties than the comparable demographic models.