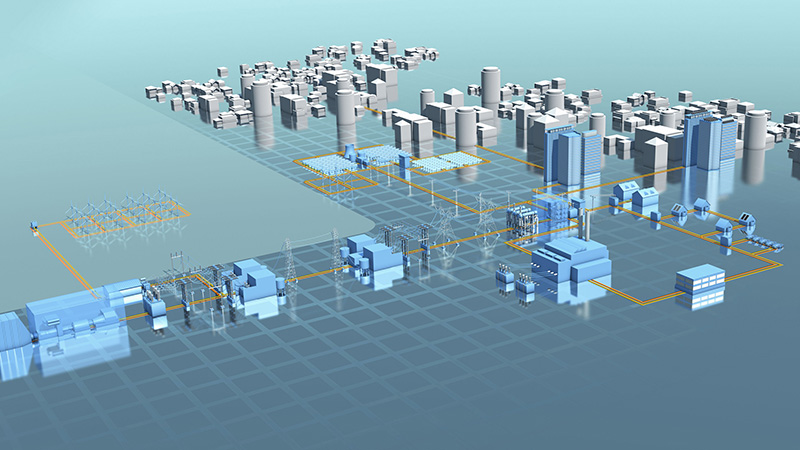

Smart Grid and Efficiency-Risk Tradeoffs

IDSS PIs: Munther Dahleh, Mardavij Roozbehani

Collaborator: Qingqing Huang (MIT)

In order to study the impact of dynamic demand response on the future smart grid, IDSS researchers used an abstracted model to examine how a tradeoff between efficiency and risk arises under different market architectures. The first part of the study explored system performance under non-cooperative and cooperative market architectures. The statistics of the stationary aggregate demand processes showed that, although the non-cooperative load scheduling scheme leads to an efficiency loss, the stationary distribution of the corresponding aggregate demand process has a smaller tail, resulting in less frequent aggregate demand spikes. Cooperative dynamic demand response, on the other hand, makes the marketplace more efficient at the cost of increased risk of aggregate demand spikes. Thus, the market architecture determines the locus of the system performance with respect to the tradeoff curve. The team also investigated how a properly designed real-time electricity pricing mechanism can help the system operator achieve a target tradeoff between efficiency and risk in a non-cooperative market.

References and Related Content:

“Efficiency-Risk Tradeoffs in Electricity Markets with Dynamic Demand Response” – IEEE Transactions on Smart Grid, January 2015.